It’s never too early to start thinking about how your retirement savings, specifically your IRA, will be handled after you’re gone. Understanding the potential IRA tax consequences for your heirs is crucial for a smooth transition and avoiding surprises down the road. This article walks you through the key considerations to ensure your legacy is handled properly.

Understanding IRA Tax Consequences

IRAs, while great for saving for retirement, can lead to unexpected tax burdens for your heirs if not planned for properly. The good news is, proactive estate planning can alleviate these potential headaches. Knowing how the rules work can help your heirs avoid unpleasant surprises when they inherit your IRA.

Inherited IRA: A Different Tax Landscape

Unlike your own retirement distributions, which are often taxed in retirement, inherited IRAs are handled differently. This means different tax implications for your heirs, depending on the type of IRA you leave behind.

Types of Inherited IRAs and Their Tax Implications

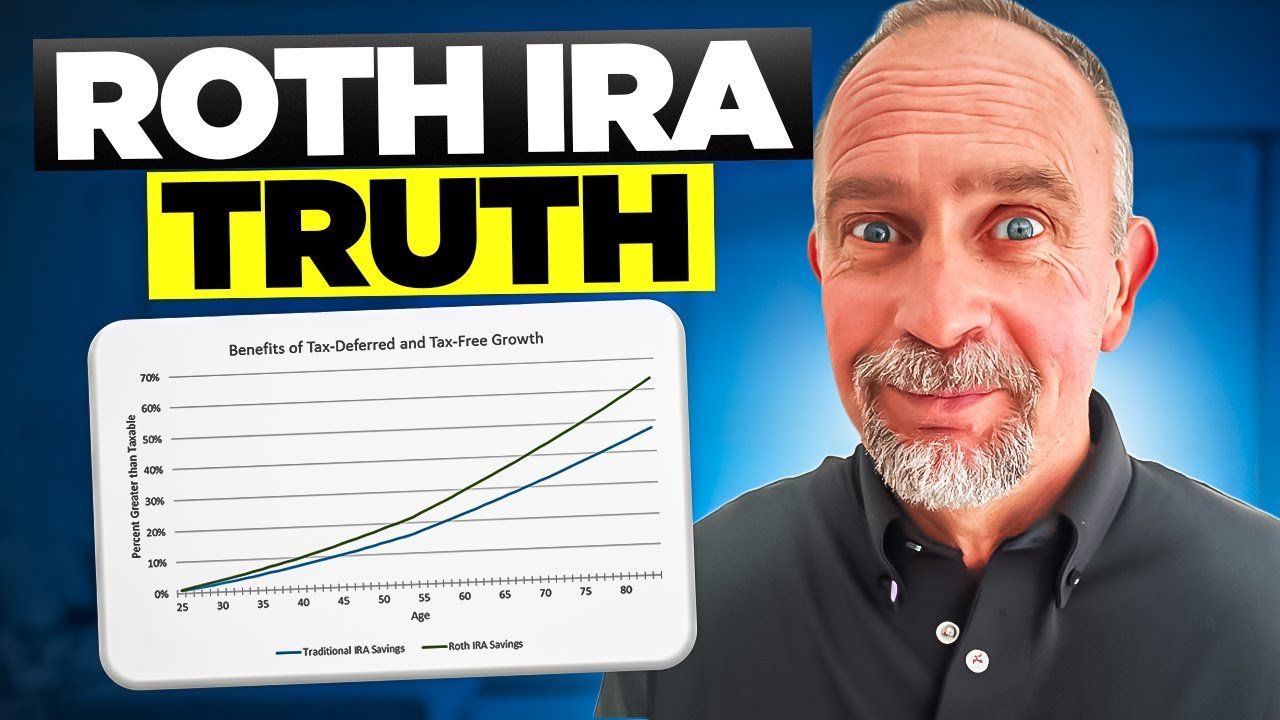

- Traditional IRA: In a traditional IRA, your heirs usually have to pay income tax on the withdrawals, but they can often take advantage of favorable tax treatment if the money is taken out over time.

- Roth IRA: A Roth IRA is generally better for your heirs because the distributions are tax-free for them (as long as the IRA is kept for long enough).

Potential Tax Implications for Your Heirs

- Tax Rate: Your heirs will be subject to ordinary income tax rates on their distributions from the IRA, which can impact their overall financial picture.

- Income Tax: Depending on your particular situation and your heirs’ circumstances, a significant tax burden might be placed on them. It’s important to understand the tax consequences based on your IRA type.

- Estate Tax: It’s possible that the value of your IRA could impact estate taxes, so working with an estate planning professional can be very beneficial.

Strategic Planning to Minimize IRA Tax Consequences

Proactive planning is key to minimizing the potential tax consequences for your heirs. Here are some strategies:

1. Professional Advice: Consult an Estate Planning Attorney

An estate planning attorney can create a tailored plan that takes into account your specific circumstances and your heirs’ needs. They can discuss the different types of trusts and how they can be used to manage the tax implications of your IRA.

2. Beneficiary Designations: Choosing Wisely

Correctly designating beneficiaries can significantly impact how your IRA is distributed and taxed. Be sure to keep your beneficiary designations up to date.

3. Tax-Efficient Distribution Strategies

Understanding how to best distribute your IRA’s assets after you’re gone is crucial. By using proper strategies, the IRA tax consequences for your heirs can be reduced.

4. Long-Term Strategies for Your Heirs

Talk with a financial advisor to help your heirs understand the best way to handle their IRA inheritance. This can include planning for potential tax implications and managing the funds in a tax-efficient way.

I hope this overview helps you better understand the IRA tax consequences for your heirs. This information is for educational purposes only and isn’t financial advice. Consulting a financial or legal professional is crucial for personalized recommendations.

Leave a comment below with your thoughts or questions! Share this article with your friends who might also benefit from this information.