Current Performance of Microsoft Stock

As of November 15, 2024, Microsoft Corporation (NASDAQ: MSFT) has seen a dip in its stock value by 2.1% during mid-day trading. The share price hit a low of $416.66, with a last recorded price of $417.74, showing a decline from its prior closing figure of $426.89. The trading volume was notably less than usual, with 7,882,910 shares exchanged—marking a 61% drop from the average daily trading volume of 20,428,129 shares.

Analyst Ratings and Price Targets

Microsoft’s stock price forecast presents a mixed picture with various analyst ratings. Despite the volatility, the consensus advises a “Moderate Buy,” coupled with an average price target set at $503.03. KeyCorp recently elevated their price projection from $490.00 to $505.00, rating Microsoft as “overweight.” In contrast, TD Cowen scaled down their target from $495.00 to $475.00, retaining a “buy” stance, while UBS Group adjusted their forecast from $510.00 to $500.00, also supporting a “buy” recommendation. Wedbush continues to maintain an “underperform” rating for the stock.

Insights from Key Analysts

An array of factors contribute to varying price target adjustments by analysts. The optimism from firms like KeyCorp stems from product innovation and market strategies that potentially bolster revenue streams. Meanwhile, Wedbush’s “underperform” rating underscores concerns ranging from market saturation to competitive pressures within the tech industry.

Financial Performance and Earnings Report

In its quarterly earnings report from October 30, 2024, Microsoft showcased robust financial achievements. The company reported earnings per share (EPS) of $3.30, surpassing the consensus expectation of $3.10 by $0.20. Microsoft’s revenues reached $65.59 billion, representing a 16% increase from the preceding year and again outpacing the projected $64.57 billion. With a net margin at 35.61% and a return on equity standing at 34.56%, Microsoft’s fiscal performance remains strong.

Implications of Financial Results

The positive financial outcome signals potential upward momentum in Microsoft’s stock price. For investors, these figures highlight continued confidence in the company’s ability to navigate tech industry challengers effectively. However, market fluctuations and external economic factors may still influence near-term performance.

Microsoft’s Dividend and Share Buyback Program

Microsoft continues to enhance shareholder returns with a quarterly dividend bump to $0.83 per share—a 10% increment from the prior dividend of $0.75. This enhanced payout is scheduled for December 12, 2024, benefiting shareholders registered by November 21, 2024. The dividend yield translates to 0.80%, under a dividend payout ratio of 27.39%.

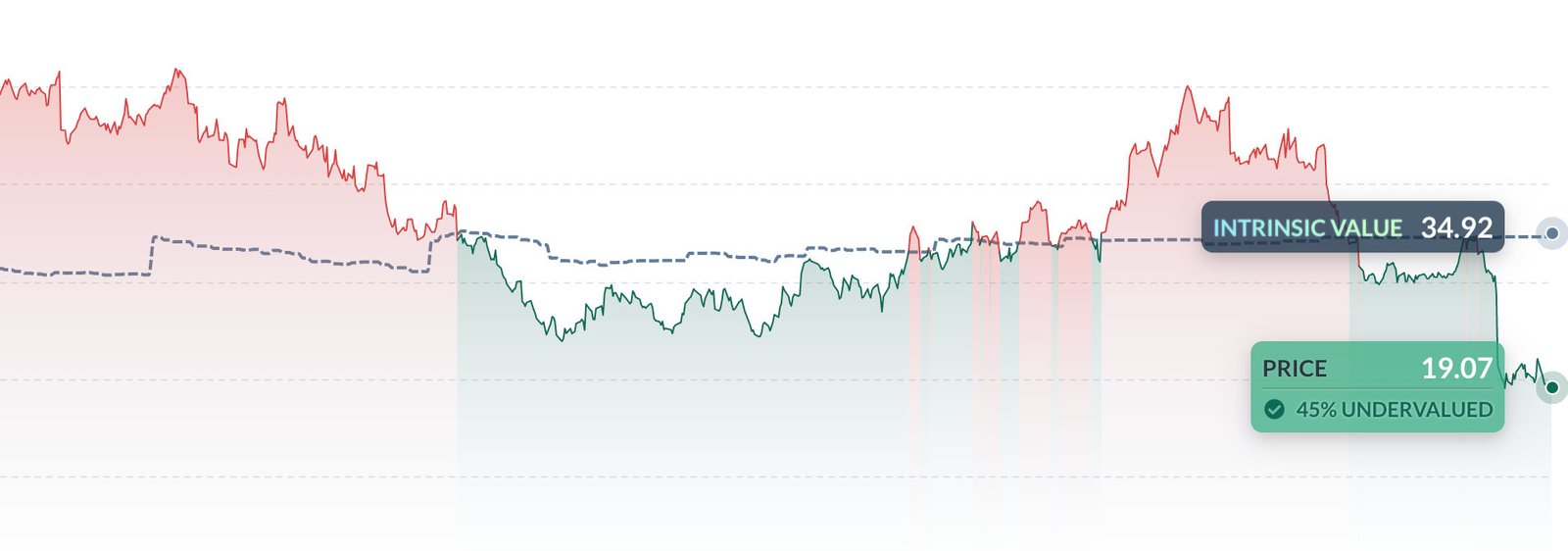

Moreover, Microsoft has launched a new share repurchase agenda, sanctioning up to $60 billion in buybacks, underscoring management’s belief in the undervaluation of their stock. This program facilitates share buybacks, thereby potentially augmenting shareholder value through increased earnings per share and valuation.

Impact on Shareholder Value

Such strategic financial maneuvers—dividend increases and substantial buyback programs—serve to bolster shareholder value. They signal company confidence, incentivizing investors with promises of future financial strength and stable returns.

Long-term Outlook for Microsoft Stock

Microsoft’s future in the stock market appears promising, with growth forecasts predicting an upward trajectory. By the end of 2024, the stock could potentially reach around $495.00—a 16.14% increase. Longer-term projections suggest prices might climb to $548.00 by 2025 and $633.00 by 2026, indicating solid growth prospects owing to Microsoft’s strategic positioning in the tech industry.

Insider Activity and Its Potential Impact

Recent insider trading activity by Microsoft’s Executive Vice President, Christopher David Young, involved the sale of 7,200 shares at an average price of $423.66 on November 12, 2024. Post-transaction, Young retains ownership of 103,366 shares. Such insider movements can impact investor confidence, depending on the perceived motivation behind these trades.

Upcoming Annual Shareholders Meeting

Microsoft has scheduled its 2024 Annual Shareholders Meeting for December 10, 2024, to be held virtually. Shareholders of record as of September 30, 2024, will have the opportunity to cast their votes. This meeting provides a platform for stakeholders to engage with Microsoft’s leadership, discussing strategic directions and priorities for the coming year.

Stay informed about evolving market trends and insights, which remain crucial for strategic investment decisions. For more comprehensive coverage of exciting tech industry developments and broader financial news, visit FROZENLEAVES NEWS.

“`