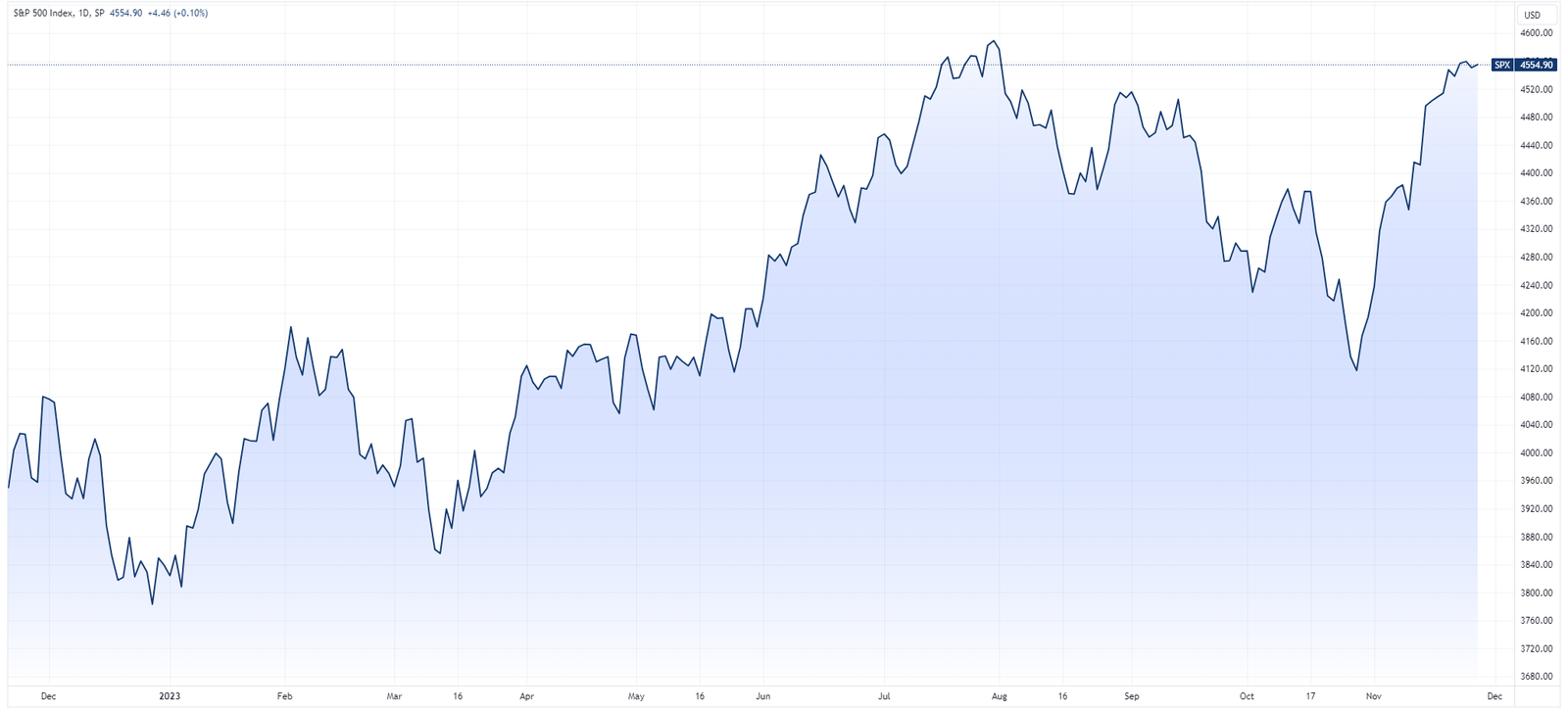

Hey everyone! A veteran market strategist is buzzing about a potential extraordinary surge in the S&P 500. Mary Ann Bartels, chief market strategist at Sanctuary Wealth, is predicting the S&P 500 will climb to between 7,200 and 7,400 by the end of 2025, with even more impressive potential growth reaching 8,000 or 10,000 by the end of the decade. This S&P 500 forecast has got the investing community talking, and I wanted to share her key takeaways with you.

SP 500 Forecast: A Look at the Big Picture

Bartels sees this market rally as similar to past booms in the 1920s, 1950s, 1960s, 1980s, and 1990s. She emphasizes that this multi-year upswing is still in its early stages. This is hugely important; it means there’s still plenty of potential upside for investors who get on board now. Importantly, she doesn’t foresee a crash anytime soon! This is because, in her analysis, there’s a whopping $6.6 trillion in cash sitting idle, waiting to be deployed. Investors aren’t overly relying on leverage, and while valuations might seem high, they’re not unreasonable when considering long-term earnings potential.

Three Key Ways to Invest for the S&P 500 Surge

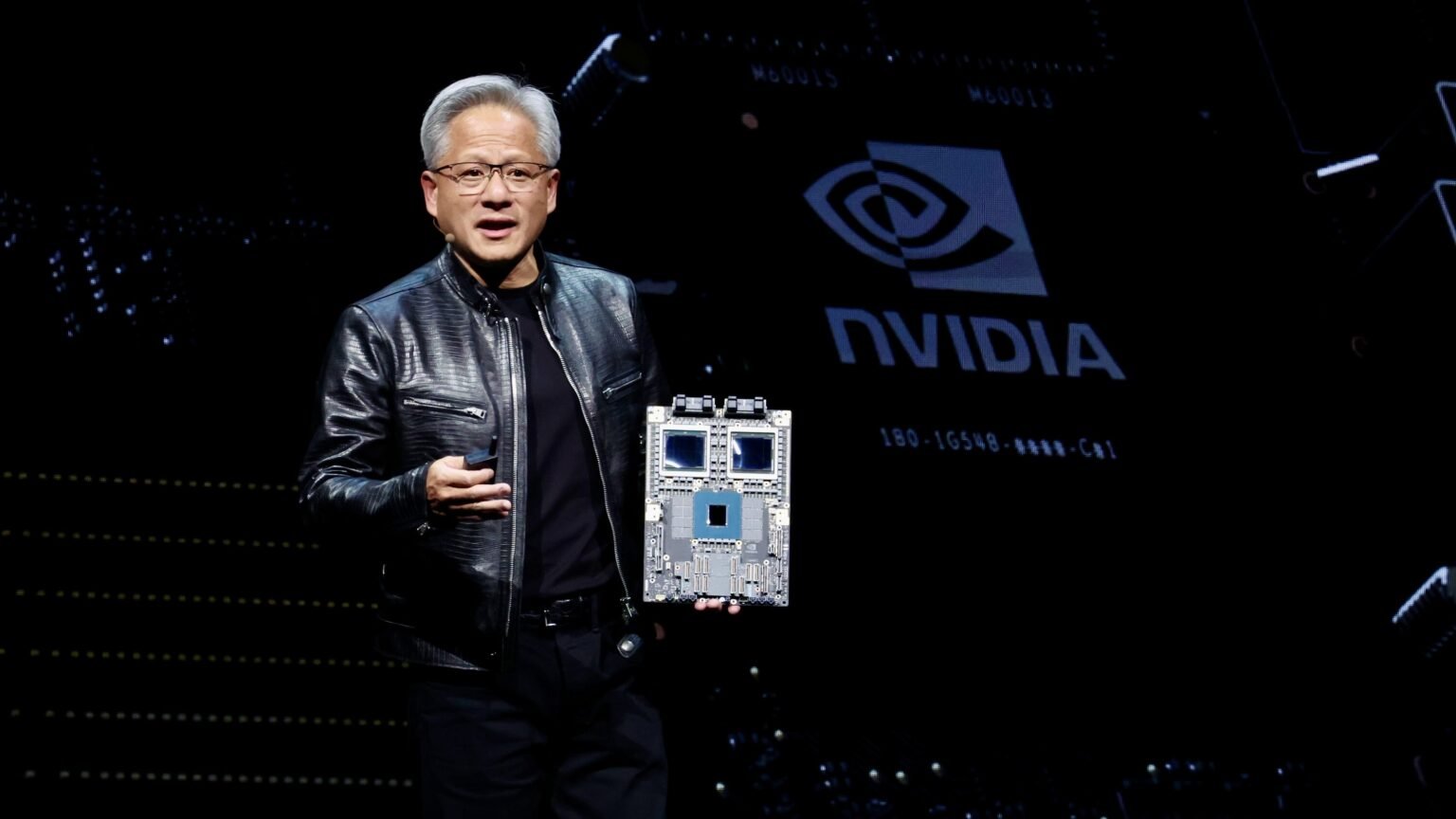

Bartels believes the best-performing assets in this environment will be stocks in cyclical sectors, such as consumer discretionary and financials. Tech stocks are also expected to deliver strong returns, particularly software companies, which have consistently demonstrated superior returns on equity over the last 25 years.

- Cyclical Sectors: Consumer discretionary and financials are expected to thrive during this market surge.

- Technology, Especially Software: Software companies are poised for strong growth, given their superior returns on equity.

Understanding the Potential Risks

While the outlook is positive, Bartels notes that the market could enter “dangerous territory” only if it rockets to 10,000 or 13,000. This underscores the importance of understanding market risks and investing responsibly. The current market climate suggests investors should not be overly concerned; her research highlights the robust foundation supporting continued growth.

What does this S&P 500 forecast mean for your money?

This bullish S&P 500 forecast suggests a multi-year growth opportunity for investors. With a potential upward trajectory, Bartels’ analysis emphasizes the importance of well-researched investment strategies. Understanding the current conditions is crucial to navigating the potential upswings and downswings and maximizing returns.

If you’re curious about how this S&P 500 forecast might impact your financial plan, I’d recommend consulting with a financial advisor. They can help you tailor a strategy that aligns with your specific needs and goals.

Leave a comment below with your thoughts and share this article with your friends. What are your S&P 500 forecast predictions? Let’s discuss!

“`